Fees flexibility on Fundment - a guide

Welcome to Adviser Fee Flexibility on Fundment – designed to put you in control.

Your business, your rules…

Every client relationship is unique, which is why we've built a fees system to match. With Fundment, you can:

Create fee variations to match your service offerings

Set a firm-wide default while maintaining flexibility for individual clients

Customise fees for specific client goals and accounts

Fine-tune your pricing with custom tiering

Set automatic fee increases at intervals that suit you

Quick set-up in your dashboard

Getting started is simple. Head to Administration > Fees to access your fees dashboard.

Here you'll find two sub-menus: Fee schedules and Fee frequency.

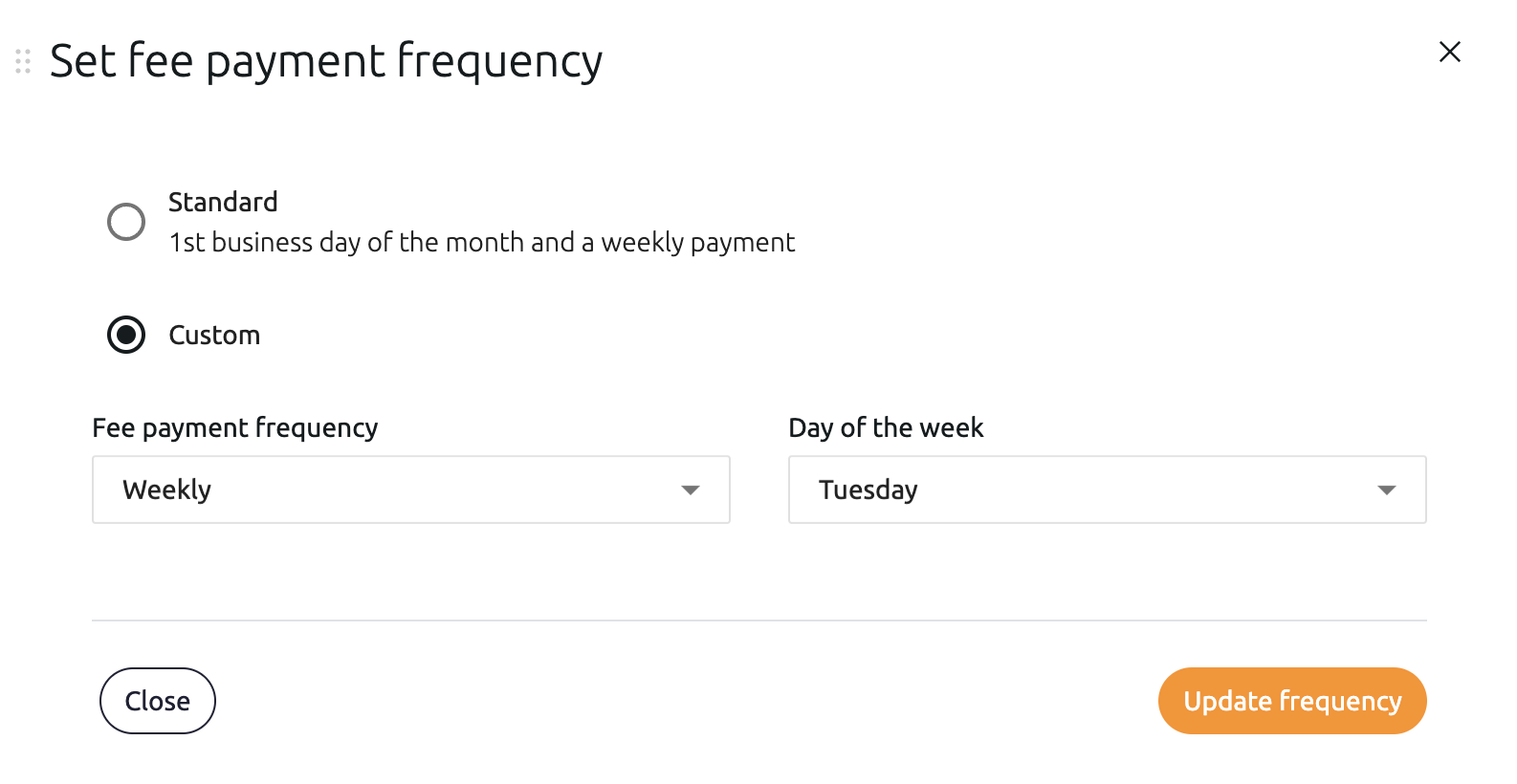

Fee schedules contains your active fees, archived fees, and the option to create new fee structures with just a few clicks. Fee frequency contains your fee generation and fee payment features.

Enhanced cash flow management

Take control of your revenue stream with our customisable fee generation and payment schedules.

You now have the ability to…

Generate fees your way

Monthly on your preferred date

Weekly on your chosen working day

Receive payments that suit you

Daily

Weekly on your selected working day

Monthly on your preferred date

Practical payment scenarios

Here are two examples of setting your own fee generation and fee payment cycles, and how they would work:

Monthly generation with weekly payments:

Your initial payment includes the full month's due fees, followed by weekly payments covering any outstanding fees and new transactions.

Weekly generation with weekly payments:

Receive a streamlined weekly payment combining ongoing fees and any pending charges.

This approach aligns all fee types in your payment schedule.

Transparent fee reporting

Stay informed with our comprehensive fee remittance reports, updated automatically the next business day after each payment.

Automatic fee increases

You can set automatic fee increases at intervals that suit you.

Select how often you would like your fee to update (quarterly or annually), pick a start date, and select a mechanism: fixed monetary amount, fixed percentage, or by CPI or RPI. You can even adjust the benchmark if you wish (e.g. RPI + 1%).

How benchmark-based fee increases work

As well as a fixed monetary amount or a fixed percentage, adviser fees can be automatically updated using CPI or RPI inflation data from the ONS.

You can choose:

Annual updates: Based on the 12-month percentage change.

Quarterly updates: Based on the latest three-month change.

For example, if CPI rises 3.85% over the year, a £1,000 fee becomes £1,038.50. Quarterly changes work the same way, just over a shorter period.

You can also apply a percentage offset, such as RPI + 1%, to increase beyond inflation.

Updates use the most recent CPI/RPI figures available before the scheduled change. Timing matters: we will always try to use the latest figures but setting updates at the start or end of a month ensures the freshest data.

Figures are published monthly - check the ONS release calendar for dates.

We're here to help

Ready to optimise your fee management? Visit Administration > Fees to get started.

Our support team is ready to assist you with any aspect of fee management. Whether you're setting up new fee structures or optimising your payment schedule, reach out to support@fundment.com